Uncertainty and Risk in Retirement

In thinking about their future retirement years, most people naturally focus on the ways they might like to spend their time and energy. Then, as their anticipated retirement dates draw nearer, various uncertainties and risks enter more prominently into the thought process. With ever lengthening life expectancies, a healthy person might reasonably anticipate a retirement of thirty years or more. Unexpected events can, and likely will, occur during such a long time span.

Volatility in investment returns and the timing of bear markets are obvious risks. Experiencing a bear market in the first years of retirement can have a major adverse impact both financially and psychologically.1 Other uncertainties or risks that can shake the confidence of people approaching retirement include:

- Lifestyle spending – What if I spend, or wish I could spend, more than anticipated in retirement because I have more time to travel, connect with friends, and pursue various interests?

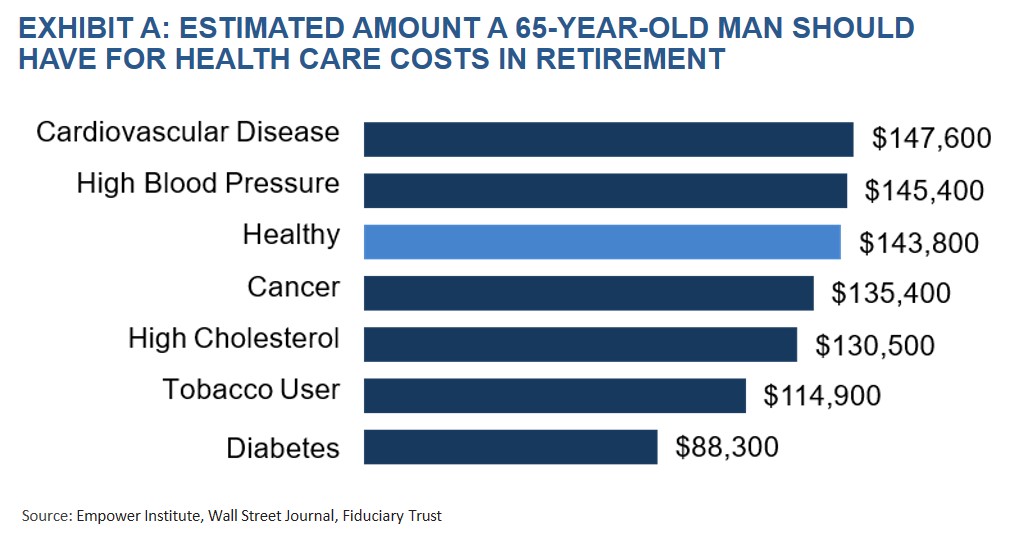

- Health care costs – What if one of us receives a serious diagnosis resulting in major unanticipated health care costs? Actually, the more pertinent question might be, “What if I am fortunate enough to maintain my good health?” As illustrated in Exhibit A, those who enjoy good health may in the aggregate spend more on health care costs over the course of their retirement years than those who suffer a serious health condition.2

- Supporting family members – What if one of my adult children, a brother or sister, or my parents have health, divorce, job, or other setbacks and need my financial assistance?

Managing Uncertainty and Risk with Diversification

In managing our clients’ investments, we strive to construct “all-weather” portfolios that should withstand the ups and downs of market cycles over long time periods. The most important attribute of these portfolios is that they are diversified—they contain investments in asset classes that should provide varying levels of income, capital appreciation, and volatility, as well as returns that are not closely correlated (i.e., are not in lockstep).

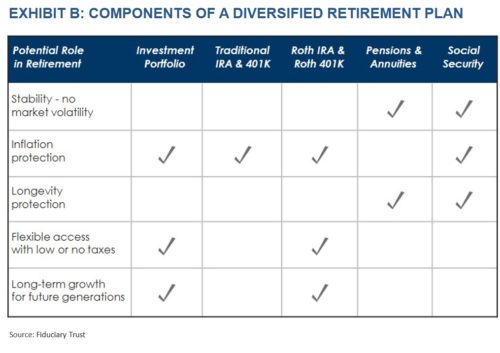

This diversification concept also can be used to reduce risk in building a financial plan for retirement. Diversification in this context refers to having sources of cash flow in retirement that have varying income, capital appreciation, tax, and other features. An “all-weather” financial plan for retirement should provide the stability and growth required to fund a long retirement, as well as the flexibility needed to address unanticipated events and corresponding financial demands.

When the overriding goal becomes building such an all-weather retirement plan, this can inform specific financial decisions that people frequently face. To illustrate, we’ll discuss three such decisions: 1) whether to have Roth IRA and/ or Roth 401(k) accounts, 2) when to start Social Security retirement benefits, and 3) whether to take a lump-sum payment from a defined benefit plan or stay with a pension income stream.

Roth Accounts: Roth accounts offer an exceptional income tax benefit—the investment return is never taxed. Each year interest, dividends, and capital gains generated in these accounts are exempt from tax. In the future, any amounts withdrawn are also tax-free, if certain conditions are met.3 Roth accounts also provide wonderful spending flexibility for retirees because minimum distributions are not required at any age.

Despite these exceptional benefits, many people shun Roth accounts due to the up-front tax costs involved. Converting a traditional IRA to a Roth IRA causes immediate tax on the amount converted. For those still working, selecting a Roth 401(k) option in an employer plan results in paying taxes on the salary reduction amounts contributed to the plan, rather than excluding them from gross income as with a conventional 401(k). Another factor considered in deciding whether to have a Roth account is a comparison of one’s current income tax rate with the rate anticipated in the future when withdrawals will occur. Many “guesstimate” that their tax rate in retirement will be lower than it is now while they are working and earning high incomes and, thus, they reject the idea of funding a Roth account.

Although income taxes should be considered, it is also important to recognize that Roth accounts can be a valuable part of an all-weather financial plan that includes an array of accounts that are diversified in terms of their tax treatment. With no required distributions, Roth accounts can be preserved, grow free of tax, and be available as a ready source of funds to meet unexpected circumstances. If necessary, investments in a Roth account can be sold and the proceeds withdrawn with no income tax cost. Retirees who have Roth accounts are in a better position to address unexpected financial needs than those who do not. Factoring this into the analysis should persuade more people to incur the up-front taxes involved in funding a Roth account. As an added benefit, any Roth accounts not needed during one’s retirement years can be an excellent vehicle for passing wealth to younger family members.

Social Security Retirement Benefits: The full retirement age under Social Security is 66 for those born in 1943 through 1954.4 At this age, people can start receiving their full Social Security retirement benefit (referred to as their Primary Insurance Amount or “PIA”). People can claim benefits as early as age 62, but their payments will be reduced. Those whose full retirement age is 66 will receive only 75% of their PIA if they start receiving benefits at 62. Alternatively, they can delay claiming benefits past age 66 for up to four years, and the benefit will increase each year by 8% of their PIA. Thus, at age 70 people can begin receiving Social Security payments equal to 132% of their PIA, plus additional cost of living adjustments.

In deciding when to claim Social Security retirement benefits, it is helpful to consider certain “break-even” ages. In simple dollars, the break-even point between claiming at age 62 or at age 66 is 78 years of age. People living to that age will receive the same total dollars either way. People who die younger than age 78 will receive more dollars from Social Security by claiming at age 62. For those who live longer, claiming at age 66 would be preferable. The break-even point between claiming at 66 or at 70 is 82½ years of age. The break-even ages will be somewhat older if a more sophisticated present value calculation is used.

Although one can never know, most people in good health will live beyond these break-even ages. The planning horizon also will be extended further for married couples, who must consider the life expectancy of the survivor and the availability of Social Security survivor benefits. In assessing the financial risk trade-offs, most people would prefer to delay claiming Social Security and then fall short of a break-even age rather than claim early and then live beyond that age.

Beyond focusing on break-even ages, people should consider the various sources of cash they will have in retirement. In financial planning for retirement, having an income stream, particularly one that will be adjusted for increases in the cost of living, can significantly increase the probability of having sufficient cash flow over a long lifetime. This occurs because the presence of a stable income stream reduces market dependence and its resulting exposure to volatility. For retirees whose wealth is largely asset based, Social Security can add valuable diversification to their financial plans. Delaying Social Security to increase the dollar amount of payments once they do commence can accentuate the positive impact of this income stream on the financial plan.

Pension Plan Benefits: As companies continue to manage the challenge of meeting their obligations under defined benefit plans, many employers are offering participants the option of taking an immediate lump-sum payment in lieu of the normal pension benefit in form of a lifetime annuity or, for those who are married, in the form of a joint and survivor annuity. For people in good health, an important factor in deciding whether to take this option will be the interest rate that is used to calculate the lump-sum amount. An additional factor, however, should be the role this employer plan benefit will play in one’s overall financial plan. Although annuity benefits under defined benefit plans typically provide no cost-of-living adjustments, these income streams can still provide important stability and diversification for retirees. Much like a delayed Social Security benefit, they can enhance the probability of success for a financial plan. Thus, most people fortunate enough to have a corporate pension should stay with the annuity form of payment and not select the lump sum, as long as the plan is adequately funded.

Factoring Diversification into the Decision-Making Process

The most important financial planning goal for many people is to fund their retirement years so that they are free to pursue whatever lifestyle and activities they want. A financial plan that is diversified in terms of tax characteristics and sources of cash can help accomplish this goal, while also positioning a retiree to meet unforeseen financial challenges that may arise over time. Exhibit B identifies possible components of a diversified plan and their potential roles in the plan. Considering this diversification concept along with traditional modes of analysis should lead to better decision making in fiduciary-trust.com building a financial plan for anyone’s retirement.

1For this reason, when we prepare retirement projections in financial planning for clients, we include a “stress test” that assumes negative investment returns during the first two years of retirement.

2See Anne Tergeson, Healthy? You’ll Spend More on Health Care in Retirement, Wall Street Journal, Feb. 10, 2016.

3Generally the account owner must be at least 59 ½ and have had a Roth account in place for at least five years.

4It increases in two-month increments to age 67 for those born in 1960 or later.

Access the pdf version of this article